We’re excited to share that Allo has officially launched on BNB Chain, setting the stage for a new era in the tokenization of Real World Assets (RWAs). Our mission at Allo is to bring innovative financial solutions to a global audience, and we believe that BNB Chain’s robust infrastructure perfectly aligns with our goals.

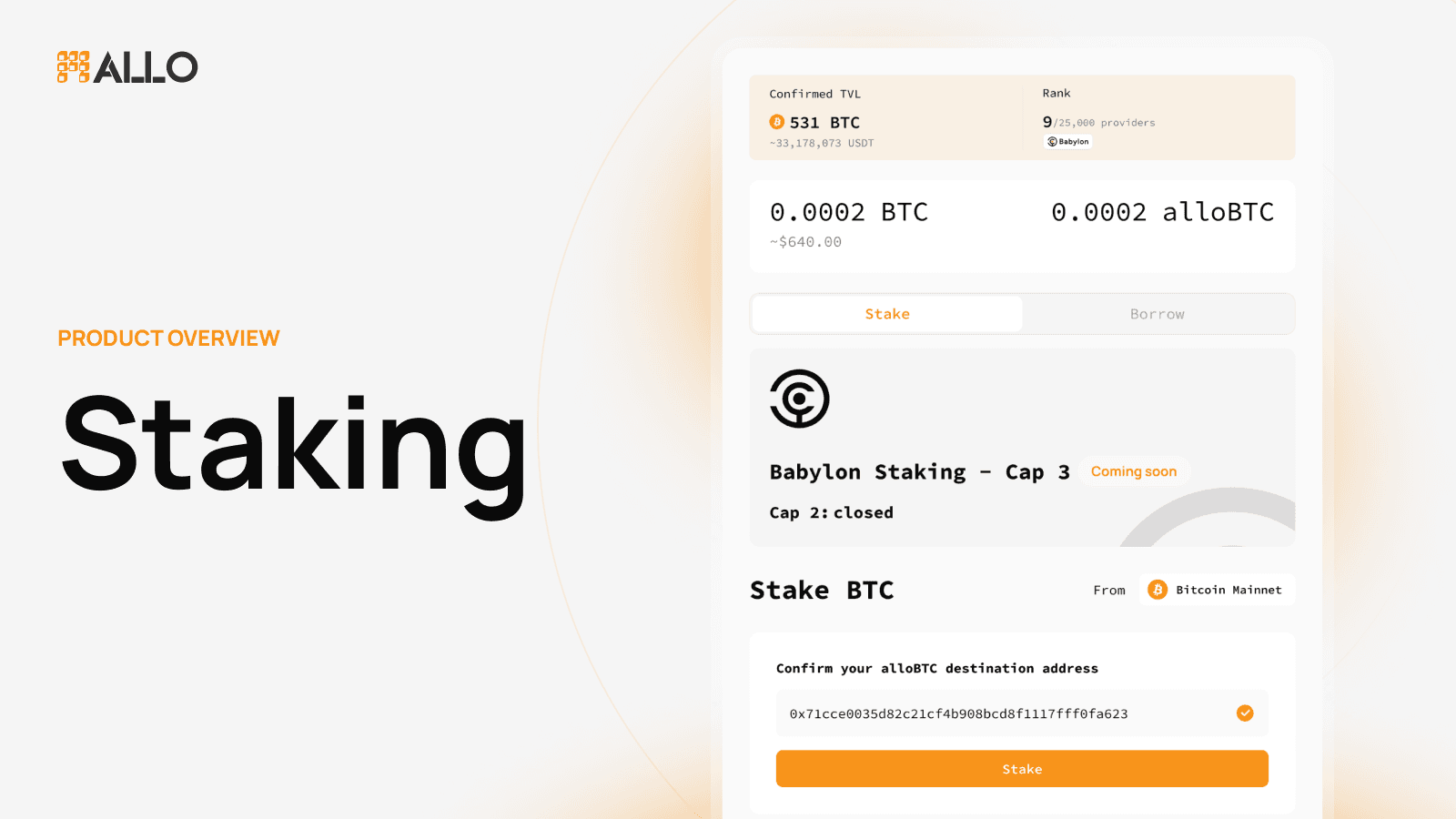

Allo has launched Babylon Bitcoin staking, introducing alloBTC as a liquid staking token(LST). By staking Bitcoin to mint alloBTC, users unlock new liquidity options, empowering them to seamlessly participate in lending and borrowing within the ecosystem. This innovation transforms Bitcoin into a versatile asset that generates yield while offering collateral for future financial activities.

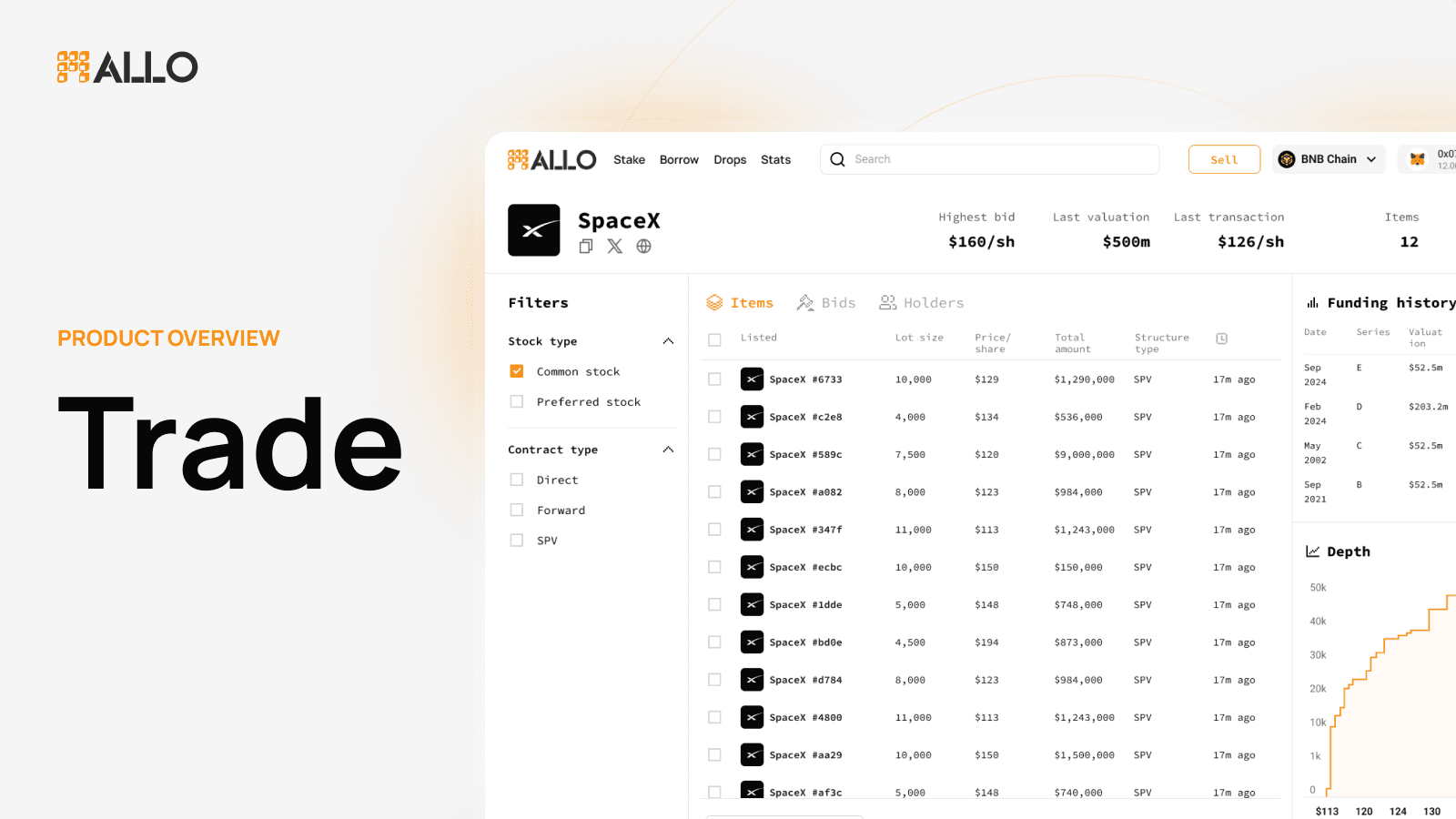

In addition, Allo has successfully deployed $2.2 billion in Real-World Assets (RWAs) on BNB Chain’s mainnet, facilitating over 25,000 transactions within the Allo RWA Marketplace. By seamlessly bridging traditional assets with blockchain technology, Allo empowers global investors to stake Bitcoin and earn rewards. Through strategic partnerships with Babylon, Bitlayer, and other leading protocols, our platform unlocks new opportunities for diversified yield and enhanced liquidity in the decentralized economy.

Allo’s Protocol for Bitcoin and RWAs with deep BNB Chain Integration

Allo Staking

Allo introduces its own solution for Bitcoin holders through the creation of a Liquid Staking Token (LST) known as alloBTC. When users deposit BTC into the Allo platform, they receive AlloBTC, which represents their staked Bitcoin.

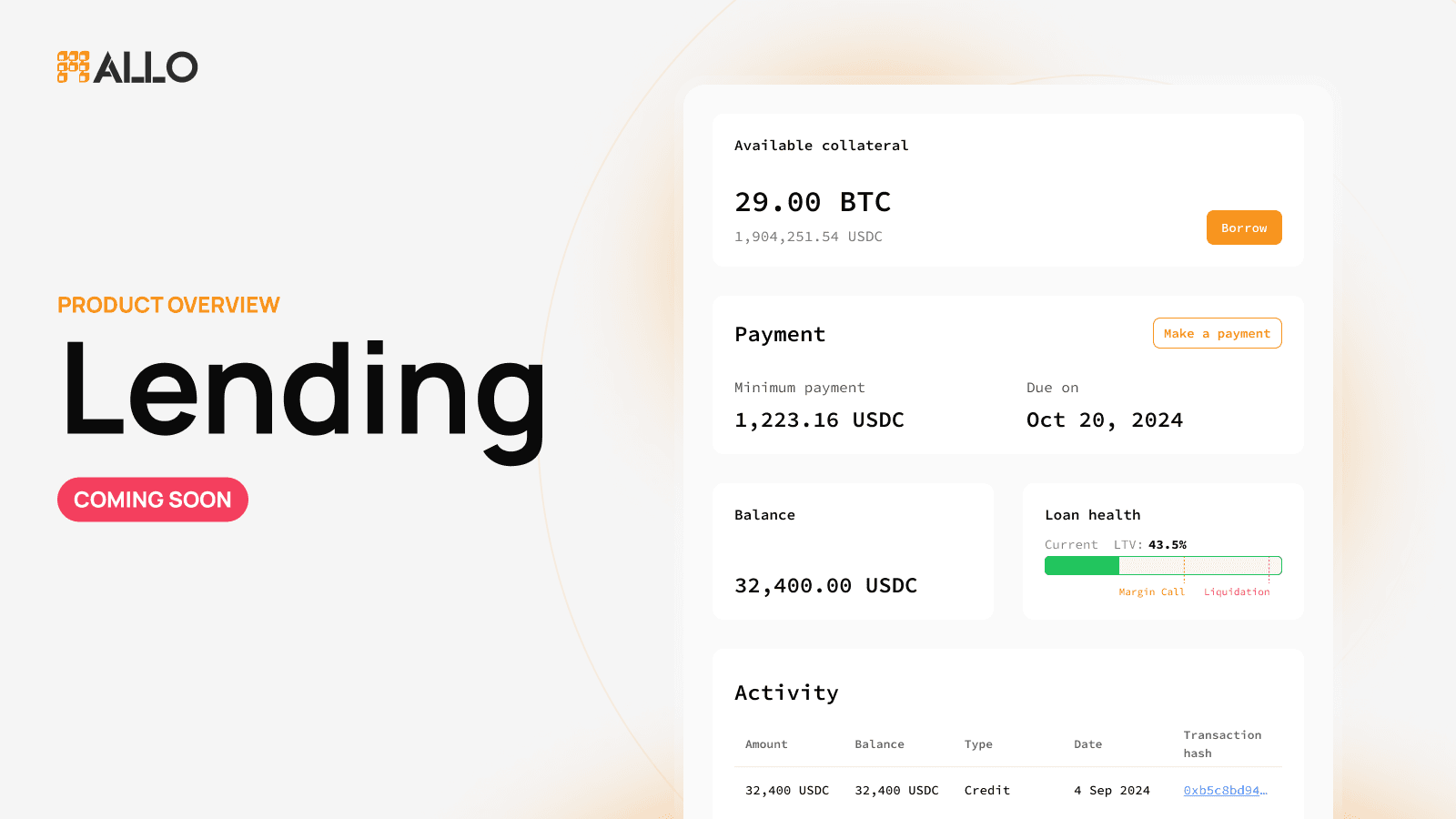

Allo Lending

Allo revolutionizes Bitcoin lending by allowing users to leverage their staked assets through AlloBTC, a Liquid Staking Token (LST). Users can borrow against their AlloBTC while still earning yield on their staked Bitcoin, unlocking liquidity without sacrificing rewards. This seamless integration of staking and lending offers greater financial flexibility and maximizes the value of users' BTC holdings

Allo RWA

Allo has deployed $2.2 billion in Real World Assets (RWA) on BNB Chain’s mainnet, completing 25,000 transactions via the Allo RWA Marketplace. Our platform seamlessly integrates real-world assets with blockchain technology, allowing global investors to stake Bitcoin and earn rewards through collaborations with Babylon, Bitlayer, and other leading protocols.

Why BNB Chain?

As Allo expands, the choice of blockchain is a critical factor for ensuring seamless and efficient operations. After evaluating various options, BNB Chain emerged as the ideal platform for several compelling reasons:

Low Transaction Fees: Offers significantly lower fees compared to Ethereum, making frequent transactions more affordable for users.

High Throughput and Scalability: Supports 100-150 TPS, enabling smooth scaling and handling of large transaction volumes without congestion.

EVM Compatibility: Fully compatible with Ethereum smart contracts, accelerating development and leveraging Ethereum's tools and libraries.

Strong Ecosystem and Developer Support: Provides access to a growing network of DApps, DeFi projects, and developer resources, enhancing platform capabilities.

Fast Block Times: With 3-second block times, transactions are confirmed quickly, offering a more responsive user experience.

Interoperability with Binance Ecosystem: Seamless integration with Binance Exchange, Wallet, and Launchpad, increasing user adoption and liquidity.

Lower Barrier to Entry: Combines low fees and fast transactions, making blockchain access more affordable and inclusive.

Staking and Governance: PoSA consensus enables secure staking and governance participation, empowering the community in platform decisions.

Thriving DeFi and NFT Ecosystem: Access to a robust DeFi and NFT landscape, allowing for integrations and collaborations.

Cross-Chain Capabilities: Supports cross-chain interoperability, increasing liquidity and extending user access across multiple blockchains.

The Road Ahead

Launching on BNB Chain marks a significant milestone for Allo, but it’s just the beginning. We are committed to leveraging the platform’s advantages to unlock new possibilities in the tokenization of Real-World Assets. In the near future, we will introduce Bitcoin lending and borrowing, allowing users to leverage their staked BTC for liquidity while continuing to earn yield. Our goal is to provide an unparalleled user experience that combines speed, scalability, and cost-effectiveness, reshaping the future of finance for everyone. Stay tuned as we roll out new features and integrations, and join us on this exciting journey to transform digital finance on BNB Chain.

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals. This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions.